Diversified Benefits for Expats Investing in Colombia

Investing in a foreign country can be an intelligent move for expats looking for diversified benefits in their portfolios and maximizing returns. With its dynamic economy and growing real estate market, Colombia offers a range of diversified benefits for investors.

From bustling cityscapes to serene countryside properties, Colombia presents unique opportunities that combine financial growth with social and environmental impact. In this blog, we will explore the diversified benefits of investing in projects like The CUT, and how these opportunities can enhance your investment strategy while contributing to sustainable development in Colombia.

Why diversifying your investment portfolio is essential

Diversification is a fundamental strategy in investment management that involves spreading investments across various assets to reduce risk and enhance returns. For expats looking to secure their financial future, understanding the diversified benefits of this approach is crucial. Here’s why diversification is essential:

Risk reduction

One primary reason for diversifying an investment portfolio is to mitigate risk. By allocating investments across different asset classes, such as stocks, bonds, real estate, and alternative investments, you can cushion the impact of a poor performance in any single asset. This balanced approach ensures that your portfolio remains stable, even if some investments experience volatility.

Enhanced returns

Diversification not only helps manage risk but also enhances potential returns. Different assets perform differently over time, and a well-diversified portfolio can capture gains from various sources. For instance, while stocks offer high growth potential, real estate investments like The CUT in Colombia can provide steady rental income and capital appreciation, offering a robust and diversified benefits package.

Protection against market volatility

Financial markets are inherently volatile, and external factors such as economic downturns, political instability, or natural disasters can impact asset performance. By diversifying your investments, you spread exposure across different sectors and geographies, reducing your portfolio’s vulnerability to market fluctuations. This geographic diversification is particularly relevant for expats leveraging their international perspective to invest in emerging markets like Colombia.

Opportunity for Global Exposure

Diversifying your portfolio allows you to take advantage of global economic growth. Investing in international markets, such as Colombia’s thriving real estate sector, provides access to opportunities that may not be available in your home country. The CUT project, for example, offers expats the chance to invest in a high-potential market with a substantial projected return on investment (ROI), benefiting from Colombia’s economic development and tourism boom.

Long-term financial security

A diversified investment portfolio is critical to long-term financial security. By spreading investments across different asset classes and regions, you create a financial safety net that can withstand economic cycles. This stability is essential for expats planning their financial future, ensuring they can meet their long-term goals and enjoy a comfortable retirement.

Capitalizing on different economic cycles

Different assets and markets operate on various economic cycles. By diversifying your portfolio, you can benefit from these cycles and avoid being overly dependent on the performance of a single market. For instance, while one market may be experiencing a downturn, another might be on the rise, balancing out your overall portfolio performance.

Exploring The CUT investment project

What is The CUT?

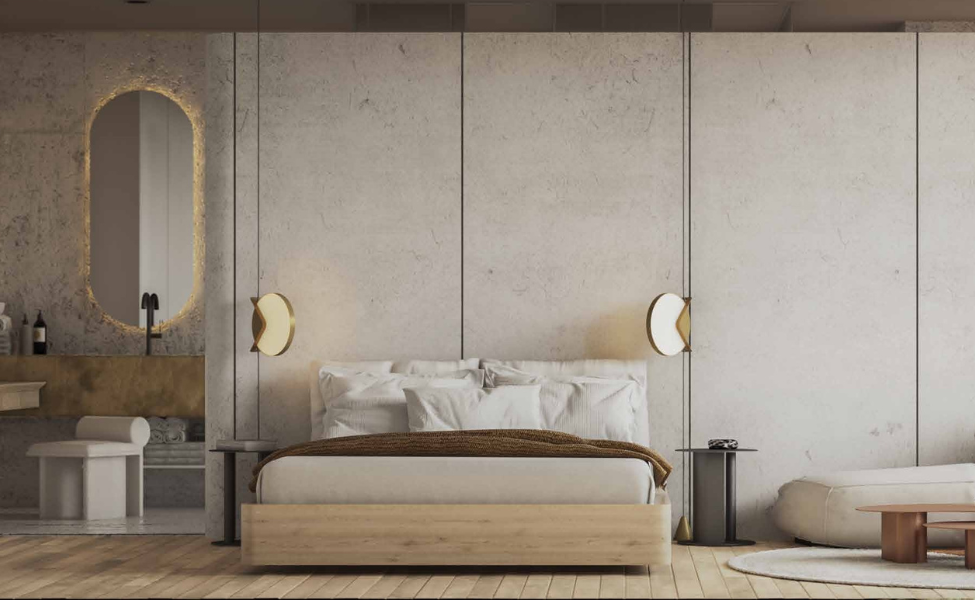

The CUT is a premier real estate investment project located in the vibrant and culturally rich city of Medellín, Colombia. Designed to be a multi-functional development, The CUT offers diversified benefits for expats looking to invest in a high-growth market. Here’s a closer look at what makes The CUT an attractive investment opportunity:

It is strategically situated in the Manila neighborhood of Medellín, one of the city’s most dynamic and rapidly developing areas. This bohemian district is renowned for its artistic community, trendy cafes, gourmet restaurants, and vibrant nightlife. The location boasts an average hotel occupancy rate of over 80%, underscoring its popularity among tourists and business travelers.

Medellín is a city on the rise, frequently recognized as one of the best-emerging destinations in South America. Known for its pleasant climate, innovative urban development, and robust economic growth, Medellín offers a compelling environment for real estate investment.

Features of The CUT

The CUT is designed to cater to diverse needs, providing multiple revenue streams and diversified benefits for investors. Key features of the project include:

1. Hotel: The CUT will house a modern hotel with 100 rooms catering to tourists and business travelers. The hotel is expected to benefit from the high tourist influx and the neighborhood’s charm, ensuring steady occupancy rates and rental income.

2. Rooftop: One of the standout features of The CUT is its expansive rooftop, the largest in the city, spanning over 1,400 square meters. This space will serve as a premium venue for events, dining, and entertainment, attracting visitors and generating significant revenue.

3. Gastronomic Hub: The CUT will include a gastronomic hub with various restaurants and bars. This feature not only adds to the appeal of the development but also creates a vibrant social scene, attracting both locals and visitors.

4. Business Hub: With 1,000 square meters of office space, The CUT provides a professional environment for businesses and entrepreneurs. This business hub is designed to meet the growing demand for flexible and modern office spaces in Medellín, offering another steady income stream.

5. Sustainable Design: The CUT incorporates sustainable building practices and innovative design elements, ensuring it meets high environmental standards. This commitment to sustainability enhances the project’s appeal to eco-conscious investors and tenants.

The CUT offers an attractive internal rate of return (IRR) of 12%, making it a lucrative option for investors seeking stable and high-yield investments. The diverse revenue streams from the hotel, rooftop, gastronomic, and business hub provide a balanced investment portfolio, reducing risk and enhancing returns.

Contact us to learn more about this project.

Partnering with Gutierrez Group

Partnering with Gutierrez Group can make all the difference when maximizing the diversified benefits of investing in Colombia. We at the Gutierrez Group offer comprehensive investment and legal advice tailored to the unique needs of expats and international investors.

Our extensive knowledge of the Colombian market provides strategic investment advice. Whether you’re looking to invest in real estate, like The CUT, or other high-growth sectors, our expert guidance will help you make informed decisions.

Navigating the legal landscape of a foreign country can be complex. Our legal team offers robust support to ensure all your investments comply with local regulations. They handle everything from property acquisition and tax compliance to contract negotiations and due diligence. This legal expertise minimizes risks and ensures your investments are secure and legally sound.

Gutierrez Group has a proven track record of managing large-scale investment projects, delivering significant diversified benefits to investors. Their experience and success in the industry make them a trusted partner for expats looking to invest in Colombia. Here are some key highlights of their expertise:

1. Years of Experience: With over 15 years of experience in the Colombian market, we have a deep understanding of the economic, regulatory, and social factors that influence investment outcomes. Our long-standing presence in the market provides a solid foundation for identifying and capitalizing on profitable opportunities.

2. Successful Projects: Gutierrez Group has managed numerous high-profile projects, including residential developments, commercial properties, and mixed-use complexes like The CUT. Our ability to deliver projects on time and within budget has earned us a reputation for reliability and excellence.

3. Comprehensive Project Management: From project conception to completion, Gutierrez Group oversees every aspect of development. Their comprehensive project management services include site selection, design and planning, construction supervision, and marketing. This holistic approach ensures that each project meets the highest quality and performance standards.

If you want to learn more about what we do, click here.

Conclusion

Investing in Colombia offers expats diverse benefits, from high financial returns to social and environmental impact. Projects like The CUT, thanks to their multiple revenue streams and sustainable design, provide unique opportunities to enhance your investment strategy.

Partnering with Gutierrez Group ensures you receive expert investment and legal advice, maximizing the diversified benefits of your portfolio. Embrace the potential of Colombia’s growing market and secure your financial future with a strategic, diversified investment approach.

Excellent read, I just passed this onto a friend who was doing a little research on that. And he actually bought me lunch as I found it for him smile Therefore let me rephrase that: Thank you for lunch! “We have two ears and only one tongue in order that we may hear more and speak less.” by Laertius Diogenes.